In 2014, as virtual currencies such as Bitcoin gained popularity in the Philippine market, the Bangko Sentral Pilipinas (“BSP”) issued a cautionary directive in the form of an advisory. The BSP informed the public about the features, benefits, and risks associated with virtual currencies. Following the increased use of virtual currencies for payments and remittances in the Philippines, the BSP issued Circular No. 944, series of 2017, which established a formal regulatory framework for Virtual Currency Exchanges (“VCEs”). There are seventeen (17) VCEs registered with the BSP as of November 30, 2020. Similarly, in 2019, the BSP approved the first installation of a bitcoin ATM inside a UnionBank branch in Makati City, located at the intersection of Ayala Avenue and Paseo de Roxas.

Recognizing the potential of virtual assets to revolutionize financial service delivery both domestically and internationally, the BSP issued Circular No. 1108, a series of 2021 (“BSP Circular No. 1108”) this year. According to BSP Circular No. 1108, a “virtual asset” is any type of digital unit that can be digitally traded or transferred and used for payment or investment. Virtual assets are “properties,” “proceeds,” “funds,” “funds or other assets,” and other “corresponding value” that can be used as a medium of exchange or a form of digitally stored value. The definition of virtual assets excludes digital units used for I payment of goods and services solely provided by the issuer or a limited set of merchants specified by the issuer (e.g. gift checks); or (ii) payment of virtual goods and services within an online game (e.g. gaming tokens).

Regulation of Virtual Asset Service Providers

BSP Circular No. 1008 governs Virtual Asset Service Providers (“VASP”), which are entities that provide services or engage in activities that facilitate the transfer or exchange of virtual assets by engaging in one or more of the following activities:

- Exchange between virtual assets and fiat currencies;

- Exchange between one or more forms of virtual assets;

- Transfer of virtual assets; and

- Safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets.

Previously, entities that are regulated under BSP Circular No. 944 are VCEs, which are entities that offer services or engage in activities that provide a facility for the conversion or exchange of fiat currency to virtual currency or vice versa. The definition of VASP in BSP Circular No. 1008 has broadened the scope of regulated activities for entities dealing with virtual assets.

The term “Virtual Asset Service Provider” was not coined by the BSP. Indeed, the term “Virtual Asset Provider” is defined in the 2018 Implementing Rules and Regulations of Republic Act No. 9160 (or the “Anti Money Laundering Act”), as amended, as any person who, as a business, conducts one or more of the following activities or operations for or on behalf of another person:

- Exchange between virtual assets and fiat currencies;

- Exchange between one or more forms of virtual assets;

- Transfer of virtual assets;

- Safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets; and

- Participation in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset.

Notably, the definition of VASP in BSP Circular No. 1108 does not include businesses that participate in and provide financial services in connection with an issuer’s offer and/or sale of a virtual asset. The Securities and Exchange Commission (“SEC”) has expressly stated in BSP Circular No. 1108 that the aforementioned business activity falls squarely within its purview. In the Philippines, the offering and/or sale of virtual assets may be considered an offer, sale, or distribution of securities under Republic Act No. 8799, also known as the “Securities Regulation Code.”

Furthermore, entities acting solely on their own behalf (i.e. not engaged in the business of actively facilitating virtual-asset-related activities on behalf of others) are not covered by the definition of VASPs.

Registration Requirements

According to BSP Circular No. 1108, an entity that meets the definition of VASP is required to obtain a Certificate of Authority (“COA”) as a Money Service Business (“MSB”) under Section 901-N of the Manual of Regulations for Non-Bank Financial Institutions (“MORNBFI”).

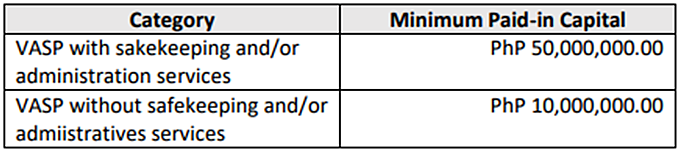

Furthermore, a VASP must have the following minimum paid-in capital:

VASPs are also required to ensure that it has complied with the following rules and regulations, among others, under the MORNBFI:

- Technology Outsourcing;

- Liquidity Risk Management;

- Operational Risk Management;

- IT Risk Management;

- Business Continuity Management;

- Internal Controls;

- Anti-Money Laundering;

- Financial Consumer Protection; and

- Sound Corporate Governance Principles.

VASPS Transactions According to BSP Circular 1108, VASPs may only transact with other VASPs, financial institutions, and/or remittance and transfer companies that have been authorized and licensed by the appropriate regulatory authorities. Virtual asset transfers between VASPs and other BSP-supervised financial institutions (“BSFIs”) are also considered cross-border wire transfers. Furthermore, the transactions must adhere to the MORNBFI’s relevant wire transfer rules.

Furthermore, a VASP that transfers virtual assets worth Fifty Thousand Pesos (PhP 50,000.00) or more, or its equivalent in foreign currency, is required to obtain, retain, and transmit to the beneficiary institution the required information on both the originator and beneficiary. Typically, the beneficiary institution is required to obtain and retain the necessary information. VASPs are required to collect the following information:

- originator’s name (i.e. the sending customer);

- originator’s account number used to process the transaction (e.g. virtual asset wallet);

- originator’s physical (geographical) address, or national identity number, or customer identification number that uniquely identifies the originator to the ordering institution, or date and place of birth;

- beneficiary’s name; and

- Beneficiary account number where such an account is used to process the transaction (e.g. virtual asset wallet).

In any single transaction with customers or counterparties, large value pay-outs of more than Five Hundred Thousand Pesos (PhP 500,000.00) or its equivalent in foreign currency shall only be made via check payment, direct credit to deposit accounts, or account to account transfer using electronic fund transfer facilities.

Notification and Reporting Requirements

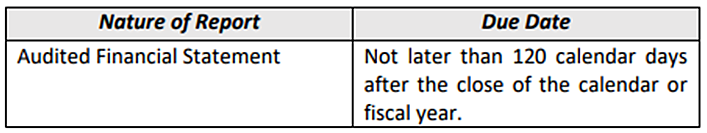

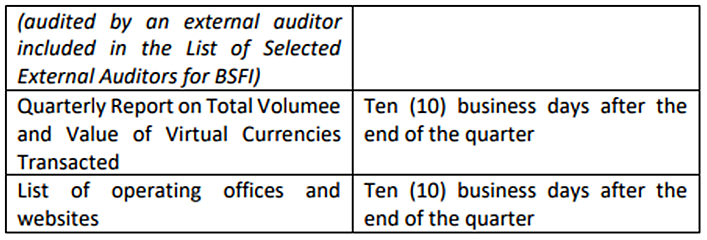

A VASP is required to submit the following documents to the BSP in addition to the notification and reporting requirements for MSBs under Section 901-N of the BSP MORNBFI: